The Administration of the Patrimony of the Apostolic See (APSA) will have a reduced role in the Vatican's new financial landscape. In essence it will become the Treasury, or central bank, for the Holy See and the Vatican City State.

Up until the announced reforms, APSA had two divisions. The Extraordinary Section managed a large sovereign fund, tracing back to the Lateran Accords, where Italy agreed to compensate the Vatican financially for its loss of territory.

Meanwhile, the Ordinary Section managed the Vatican's massive real estate holdings. But it also provided funds 'necessary for the Roman Curia to function.â? Basically, APSA decided how and where the money was spent.

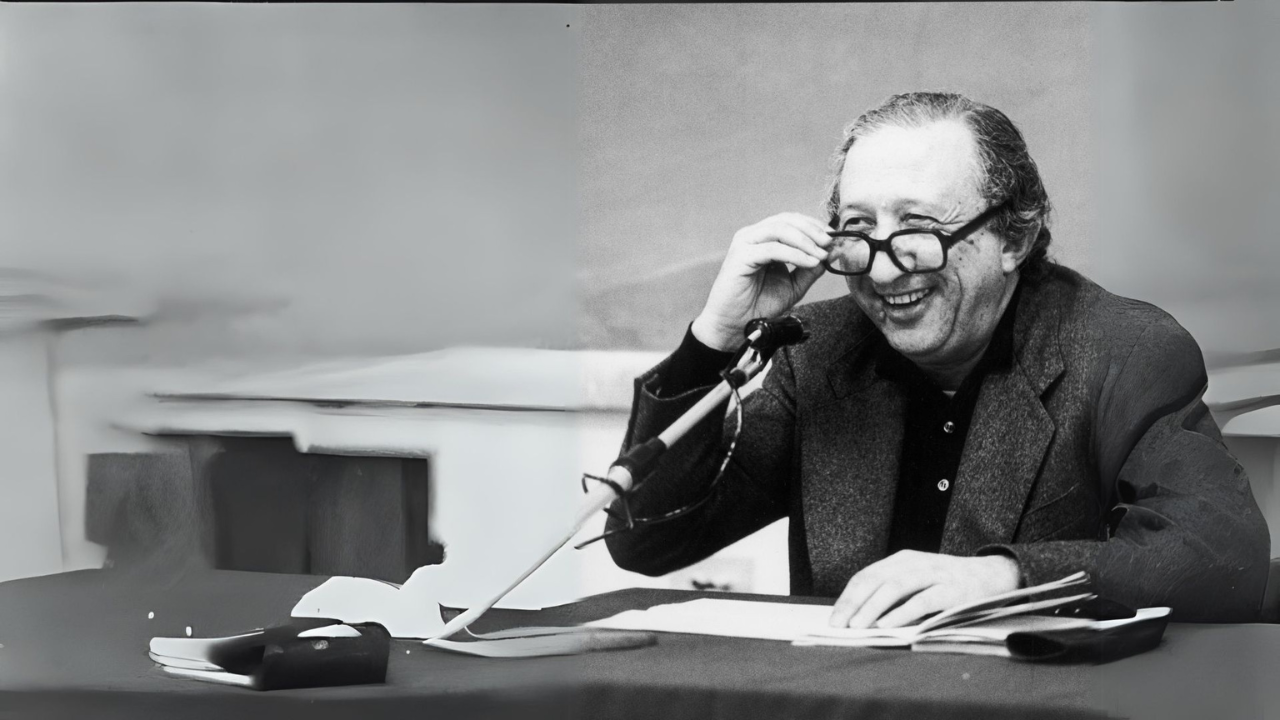

CARD. GEORGE PELL

Prefect, Secretariat of the Economy

'The Holy Father has published a motu proprio transferring the Ordinary Section of APSA into the Secretariat of the Economy, so that the Secretariat can better exercise its responsibilities for economic control and vigilance over the agencies of the Holy See.â?

As the newly-created Secretariat absorbs the economic decision-making branch of APSA, its leader, Card. George Pell, hired a familiar face to help with a smooth transition: the former business manager from the Archdiocese of Sydney.

According to the motu proprio, APSA's remaining services, managing real estate holdings and the sovereign fund, will merge under one department. The new structure will solidify its role as the Vatican's central bank.

CARD. GEORGE PELL

Prefect, Secretariat of the Economy

'The aim of the APSA as a Treasury will be to ensure that liquidity and financial stability of the Holy See and all sovereign institutions within the Holy See will have an account at APSA.â?

As the central bank, APSA will continue establishing 'working relationshipsâ? with other central banks. To date, the Vatican has signed agreements with several countries, including the Bank of England, the U.S. Federal Reserve, and Germany's Bundesbank.

The origins of APSA dates back to the fall of the Papal States, when the Pope created a department to oversee the properties the Vatican still controlled.

Last year, the Vatican created a special commission to review this department. At the same time, it hired the Promontory Financial Group to audit its two sections. The results from the audit and the recommendations from the special commission led to the current changes described in the motu proprio.

RCA

RR

JM

-PR

Up:AC