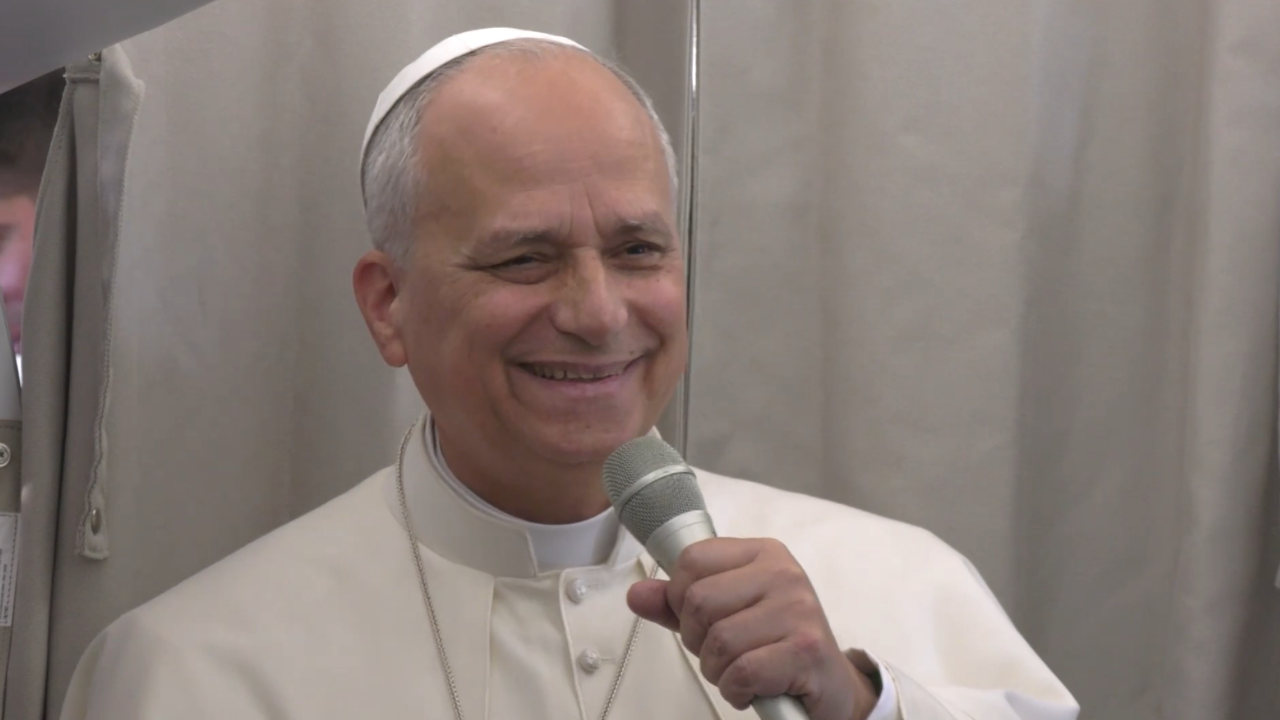

When the then-Cardinal Robert Prevost was elected as the first pope from the United States of America, there was, of course, great celebration.

However, amidst all the excitement, it occurred to many American financial advisors and politicians that the newly-elected Pope Leo XIV might have a rather complicated tax and citizenship situation considering his new position.

Unlike European countries that have popes elected in the past, the United States has not yet developed citizenship or tax laws particular to a US-born pontiff. It turns out that the IRS does not have a specific tax-code for papal rulers.

In response to the growing concern regarding Pope Leo's citizenship or the millions he may have to pay in taxes, a Colorado Congressman, Representative Jeff Hurd, has introduced the Holy Sovereignty Protection Act.

This bill seeks to prohibit the revocation of US citizenship given an American's election to the papacy and exempts that individual from U.S. tax obligations while serving as pope. While the bill has only been introduced to the floor, Rep. Hurd hopes that this bill will exemplify the “the extraordinary nature of the papacy.”

CRT